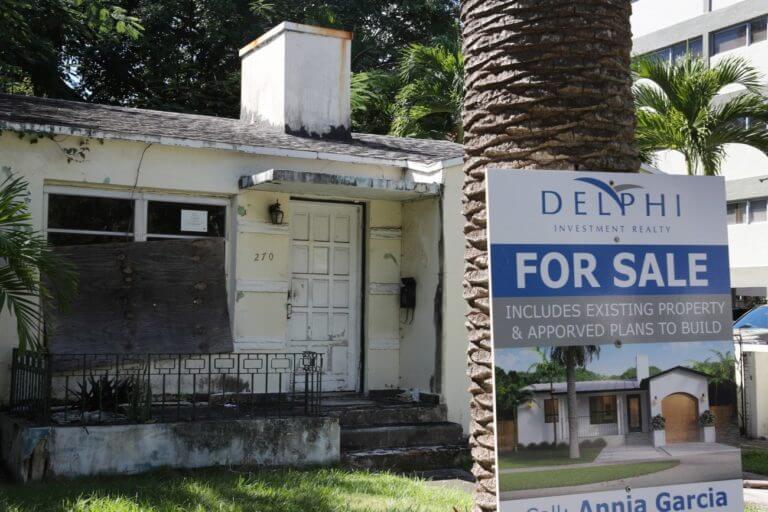

PHOTO: U.S. Housing

Back in June 2019, I published a detailed Forbes piece called “Current U.S. Recession Odds Are The Same As During ‘The Big Short’ Heyday.” In that piece, I argued that the U.S. Federal Reserve and other central banks’ aggressive monetary policies since the 2008 Global Financial Crisis created a series of extremely dangerous economic bubbles that would burst in the coming recession. Moreover, I argued that the odds of a U.S. recession in the next 12-months were approximately 64%, which was identical to the recession odds the U.S. economy faced in the Big Short heyday in July 2007. I believe that the U.S. economy was already heading for a recession and that the coronavirus pandemic has acted like a “pin” that burst nearly all of the bubbles that I was warning about.

RELATED: INTERNATIONAL PROPERTY NEWS

In this current piece, I’d like to take a quick look at one of the bubbles I warned about in my June 2019 piece – U.S. Housing Bubble 2.0 – and why I believe it is at risk of bursting in the recession that we are already likely in. Like the other bubbles I’ve been warning about, U.S. Housing Bubble 2.0 formed as a result of the Fed’s extremely stimulative monetary policies in the past decade – namely zero interest rate policy (ZIRP) and quantitative easing (QE).

READ MORE VIA FORBES