PHOTO: Homebuyers are being warned the cost of a house is set to stop falling despite interest rates sitting at their highest level in a decade. FILE

The cost of purchasing a home looks to be back on the rise, at least for the time being, in an unwelcome change for those looking to buy a property.

The average cost of buying a home in Australia increased by 0.13 per cent in March with the median value currently $732,000.

House prices have been falling since the Reserve Bank began its campaign to bring inflation into line in May 2022, causing interest rates to rise for 10 consecutive months.

National home prices have reversed their downward trend, with price falls easing. Picture: NCA Newswire / Gaye Gerard

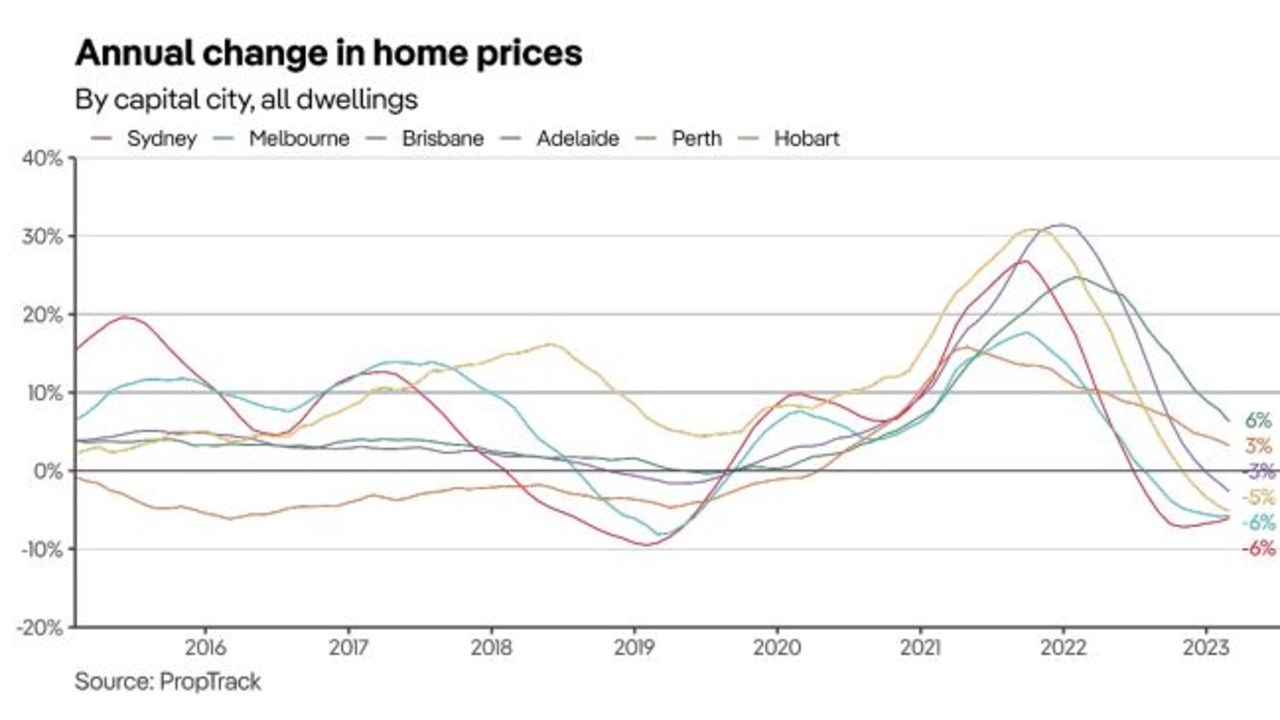

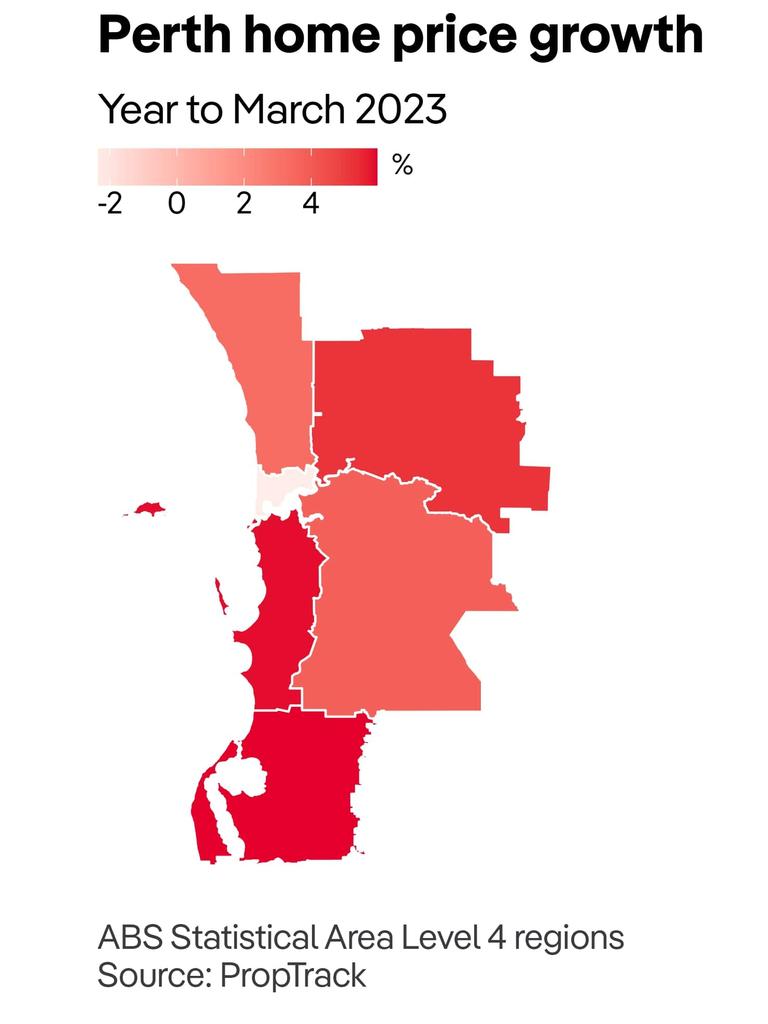

The capital cities saw price hikes throughout 2021 and parts of 2022 before they took a turn. Source: PropTrack

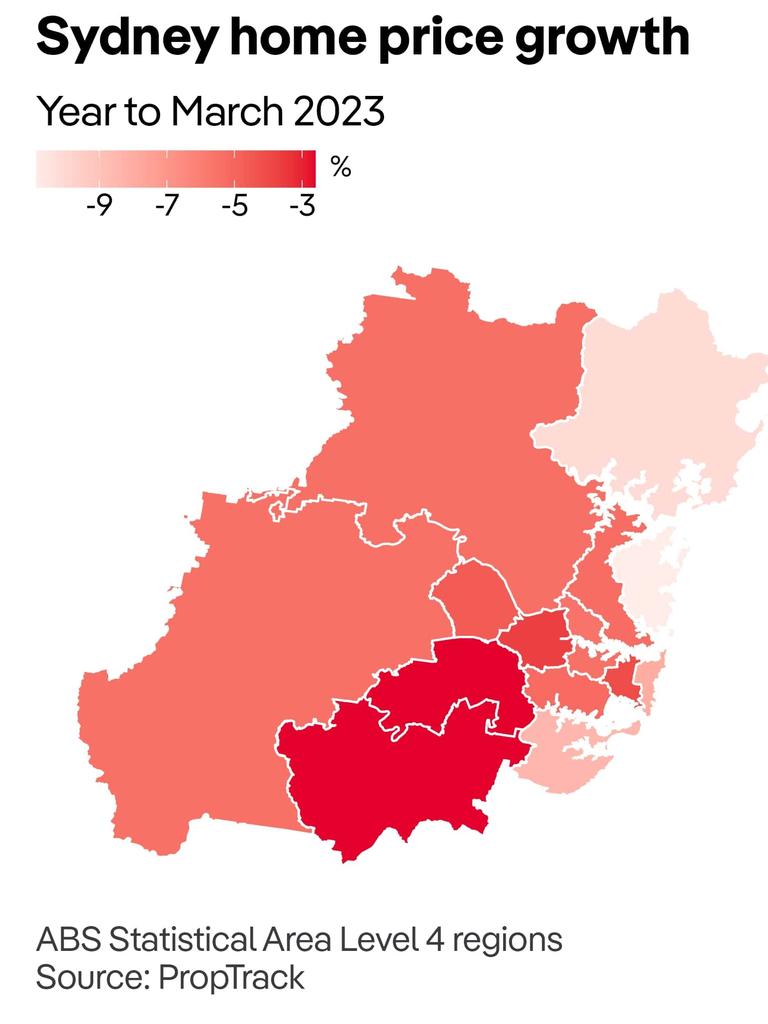

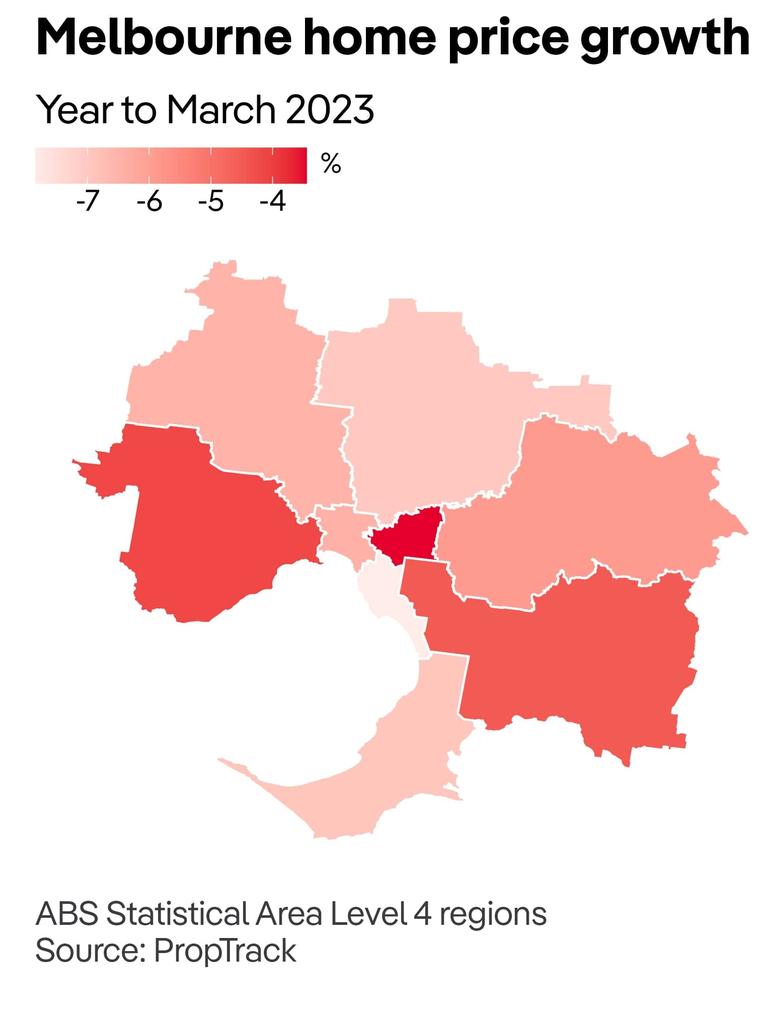

In response, Sydney’s house prices fell by 6.03 per cent in the past year to sit at an average $994,000, Melbourne’s saw a 5.79 per cent drop with the median home value now $789,000, according to the latest PropTrack Home Price Index.

However, March has seen a slight bounce in prices, with Sydney house prices rising by 0.27 per cent, Melbourne by 0.12 per cent, Perth by 0.24 per cent and Adelaide by 0.10 per cent.

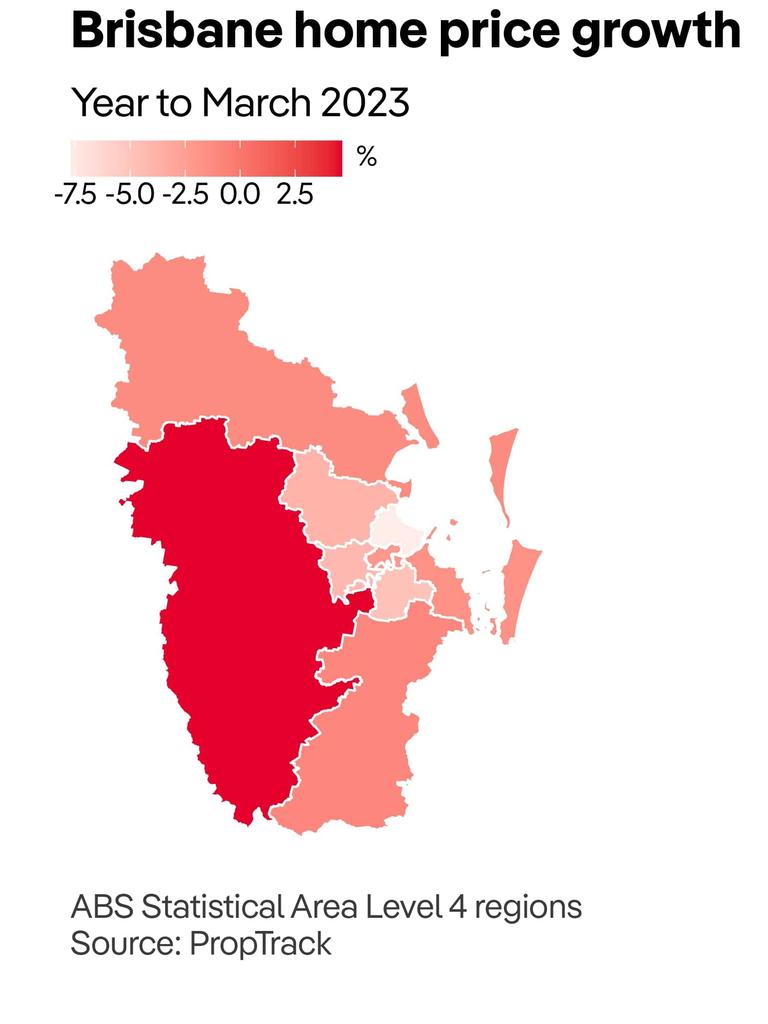

Brisbane, Hobart and Darwin bucked the trend with prices falling by 0.06 per cent, 0.43 per cent and 0.10 per cent respectively.

As rate rises drive prices down by reducing the amount of money borrowers are able to get, demand is being driven upward by increasing immigration, higher rent prices and an uptick in wages growth.

A lower number of new listings has also buoyed values according to PropTrack.

So far this year, Sydney has seen the greatest lift in values out of all capital city markets, with fewer homes on the market underpinning home prices.

In March, Melbourne home prices rose 0.12%, with the weaker flow of new listings increasing competition among potential buyers. As a result, sellers have benefited from less competition with other vendors.

After lifting in January and February, Brisbane home prices recorded a small fall in March (-0.06%), despite the flow of new listings remaining soft. Source: PropTrack

Perth home prices recorded a 0.24% increase in March to reach a new price peak.

With inflation rates still much higher than the RBA’s 2-3 per cent target and unemployment at relatively low levels, the bank may opt for another cash rate hike, but a pause is on the cards, according to PropTrack economist Eleanor Creagh.

“Concerns around inflation expectations remaining anchored and the Board’s commitment to overcoming the challenge of high inflation make a 25-basis point lift next week more likely than not. But it’s a close call and the end of interest rate rises is in sight, whether the Reserve Bank pause this month or next,” she said.

“If the RBA does lift the cash rate next week by 25bp, it will be the 11th consecutive hike, bringing the cash rate to 3.85%, its highest level since April 2012.

READ MORE VIA NEWS.COM.AU

MOST POPULAR IN NEW ZEALAND

- THE ANCIENT STONE CITY: Proof of NZ civilisation before Kupe

- Real estate agent turns himself in | WARNING: DISTRESSING CONTENT

- Real estate agent Sally Ridge’s full-scale renovation of Auckland mansion

- Claims about Jacinda Ardern’s wealth

- Why are some F45 gyms collapsing? | WATCH

- Eye surgeon accused of murdering wife puts Remuera mansion up for sale

- Prominent lawyer takes landlord to court over $3000-per-week rental property

- Abandoned land for sale

- He sometimes struggled to pay staff, but owns a $4m holiday home

- Wellington’s St Gerard’s Monastery sold after three weeks on the market